LTD claim denied? If so, you are in the right place! A long term disability denial can feel like a slap in the face. But your journey doesn’t have to end here. There are other options, and as you may have guessed, one of them is to appeal the denial.

As one of the few law firms in Canada that exclusively handles disability claims, we are well aware of the challenges involved with appealing a long term disability denial. We know how hard it can be — especially if you are doing it on your own. That is why we wrote this article and all of our other books and guides: to help people like you navigate the complicated world of disability claims.

We understand how confusing and disheartening this process can be, but since you are reading this article and educating yourself, we know you are on the right path. Keep reading to begin the journey to winning back the benefits you paid for.

Disclaimer: The information provided within this article does not and is not intended to constitute legal advice and does not substitute getting a legal consultation; all information and materials within this guide are for general information purposes only. Resolute Legal does not guarantee claim success when using this guide.

Have questions about your claim? Click on the button below to schedule a free consultation with our experienced team.

Have you had your LTD claim denied?

Denied disability insurance? You’re in the right place! In this article, we will overview two methods for appealing a denial. We will also provide you with a simple yet complete seven-step process to appeal an LTD denial.

Let’s dive in!

How to appeal long term disability denial

There are two ways of appealing a long term disability denial in Canada. The first method, referred to as an internal appeal, involves directly asking the insurance company to reconsider your decision. The other option is an external appeal. This option leaves the decision up to outside decision-makers, such as a judge.

In the sections below, we will review each method in more detail.

Appealing denial of long term disability internally

As previously discussed, if you are denied disability insurance coverage, you generally have a right to an internal appeal. If you’ve read any articles about internal appeals, you probably aren’t sure what to think about this method. Some lawyers recommend skipping them and going straight to a lawsuit, while others encourage you to try out an internal appeal to see what happens first.

Unfortunately, we can’t give you a clear answer on this either. However, in this section, we will overview situations where it makes sense to do an internal appeal and scenarios where you should skip internal appeals for a lawsuit.

Before we dive in, though, let’s take a minute to explain what an internal appeal is.

When you apply for long term disability benefits, your provider assigns an agent to review your claim and approve or deny it. If you get denied and request an internal appeal, the provider assigns a new agent to review the denial and decide whether to overturn it or let it stand.

We call this appeal “internal” because, at this point, it only involves you and the provider. “External” appeals involve an outside party, usually a judge or arbitrator.

Internal appeals are the first step in the appeals process, and most providers offer two or three rounds. But with some insurance plans, you may not need to go through all the rounds. If the first internal appeal fails, you can move right to the final appeal with the arbitrator or courts. Your HR department or union may not understand all the options that apply to you. We recommend booking a free case evaluation to get a straight answer on what options your plan allows.

When to use this method

Believe it or not, providers can and will admit when they made a mistake and approve your internal appeal. But you should only do an internal appeal if you have a chance to win. Your chances of success depend on your personal characteristics, claim evidence, and the provider’s reasons for the denial.

Your personal characteristics include your age, education, work history, pre-disability income, medical condition(s), symptoms, and temperament. If your provider missed a characteristic that validated your claim, you could point it out in the internal appeal.

Insurance companies sometimes deny claims due to your personal characteristics. For example, if you are over age 55, the insurance company may believe you want to use your disability benefits for “early retirement” rather than for a valid disability claim. Or if you have an invisible medical condition (e.g. fibromyalgia, depression, etc.), then insurance companies may assume you are exaggerating due to a lack of objective testing.

However, more often, the problem is a lack of information or gaps in your medical evidence. Common gaps in medical information can include a lack of discussion on the severity of your symptoms. Or the treatment is done and planned. On appeal, you would need to have your doctors fill in these gaps by sending a letter or a medical report to the insurance company.

The provider’s reasons for denial can include not only the stated reasons in the denial letter but also unnamed reasons. Often the unnamed reasons can relate to bias or stereotypes. Common examples include: you are too young to be disabled, you don’t like your current job, or you want an early retirement. Unstated reasons for the denial are harder to discover and dismiss.

When does it make sense to do an internal appeal?

You can win internal appeals in these kinds of situations:

- The provider denied your initial claim because they needed clarification from your doctor.

- You failed to provide the requested information.

- You refused a particular treatment or appointment when you submitted the claim, but now you have.

- Your doctor provided incomplete or vague information.

- The provider’s doctor hasn’t evaluated you yet.

- The provider has no surveillance of your daily activities.

- The provider has yet to spend much money or time on your claim.

If any of these reasons fit your situation, you should consider moving forward with an internal appeal.

Now let’s look at when you shouldn’t follow the process.

Why you should avoid this method

1. Your chances of success are slim to none

You should always go forward with an internal appeal if you have a reasonable chance of success. But what if you’re not sure what your odds are?

Consider whether any of these situations sound like yours:

- Your denial involves the two-year “change of definition” for occupation, where it switches from “own” (your last job) to “any” (whatever work you can find).

- The provider sent you to a medical examination, vocational assessment, or rehabilitation program, and you failed to follow through.

- Surveillance video shows you engaging in activities your disability should prevent.

- The provider has invested a lot of money in medical examinations, treatment, or video surveillance for your claim.

- Your denial cites technical reasons, like a pre-existing condition or late application.

- The provider blames your inability to work on your employer (a toxic work environment or insufficient accommodations for your disability.)

If any of the above situations sound like yours, don’t waste your time with internal appeals. You can still win, but you must let the provider know that you intend to pursue an external appeal. Some providers will even voluntarily reverse decisions before your case goes to court.

2. Your provider’s well is deeper than yours

Have you heard of the Fabian strategy? This tactic defeats opponents by wearing them down over time rather than facing them directly. When used successfully, the Fabian strategy drains the opponent’s resources and morale without even entering a confrontation.

Multiple rounds of internal appeals can easily become a Fabian strategy, as this process drains your ability to fight for benefits. Think about it: a delay of several months or a year has much less effect on a provider’s resources than yours, especially if you can’t work.

After several months with no income, you may no longer have the money, time, or will to push through external appeals. Out of desperation, you’ll accept the provider’s settlement terms to get the ordeal over with rather than fighting for what you deserve.

Further reading: long-term disability buyout calculator

3. You may harm your disability claim

In most cases, moving forward with an internal appeal will not harm your long term disability claim. However, if your claim involves any technical legal issues (toxic workplace or credibility problems), you can make a mess of things if you don’t carefully control your story and evidence.

For example, let’s say a “pre-existing condition” seems to exclude you from coverage under your policy. If you don’t understand what “pre-existing condition” means in your policy, you might accidentally create evidence that could hurt your case.

Or what if a toxic workplace contributed to your depression and anxiety? You and your doctor may overemphasize that factor in discussing your condition. Providers have successfully argued against paying benefits in these cases. Claiming that remedying your toxic workplace will cure your inability to work. Strangely enough, some claimants believe that focusing on the toxicity of their work environment helps. Please don’t make this mistake.

4. You may run out of time to file a lawsuit

When the provider denies your claim or terminates your benefit payments, you have a limited amount of time to file a lawsuit –usually one or two years. Lawyers can make legal noise about when the “clock” begins. However, providers will always argue that it starts as soon as you receive the first denial letter.

One of my clients found himself stuck in internal appeals for over two years, making him miss the deadline. He eventually reached a settlement with the provider. However, the missed deadline forced him to accept a smaller amount than he deserved.

Don’t accept anyone’s assurances that you have plenty of time to file for an external appeal. As soon as you receive your denial, you can begin an internal or external appeal. However, always keep that ticking clock in mind.

Long term disability appeal process (internally)

Now that you know what an internal appeal is as well as when it makes sense to move forward with one, let’s overview the process for appealing a long term disability insurance denial internally to the insurance company.

1. Identify the deadline to appeal your long term disability denial

Nothing else matters if you miss the deadline to appeal your long term disability denial.

Some appeal deadlines are soft, so missing them is no big deal. Others are hard. In other words: miss them, and you’re screwed. It’s not easy to tell the difference. So, it is best to assume that you have hard deadlines.

But how do you know the deadline?

If you got a denial letter from the insurance company, then the deadline for appeal is usually included in the last few paragraphs of the letter. If the insurance company didn’t send a denial letter, you need to ask them to put the denial in writing.

The appeal deadline will either give you a specific date (April 2, 2022). Or, it will state a certain number of days from the date on the denial letter (30 or 60 days). If you are given a number of days, you need to look at a calendar and count each day out to find your deadline.

Here is an example of what the appeal deadline looks like:

“Should you wish to appeal our decision, there is a second and final level of appeal available to you. Should you wish to appeal at the final level, you are required to provide written notification of your intent to appeal within 30 days from the date of this letter. Any new or additional medical information to support your appeal must be submitted within 90 days from the date of this letter.”

In this example, the insurance company gives two deadlines. The first deadline gives you 30 days to send a written notice of intent to appeal. The second is a full 90 days to get all the documents for the appeal.

For a broader review of long term disability benefits in Canada, check out our Ultimate Guide to long term Disability in Canada. We answer questions such as how much does long term disability pay in Canada, how to apply and more!

2. Enforce your employment rights despite your long term disability insurance denial

After denying your long term disability claim, the insurance company will send a letter to your employer. It will tell your employer that your long term disability was denied. And that you are able to work.

Upon getting this letter, your employer will likely call or write to you to ask when you plan to return to work. So, you have to inform your employer, in writing, that you disagree with the insurance company and are appealing their decision.

For many employers, that is all you need to do. They will allow you to be on unpaid sick leave throughout the appeal process of your long term disability denial.

However, some employers will take a more aggressive approach. They try to rely on the insurance company’s opinion that you can work and demand that you return to work. They will warn that failure to return to work will be viewed as abandoning your job–or something to that effect.

If you are dealing with an aggressive employer, you need to have your doctor write a new off-work note directly to them. This note or letter needs to clarify that that doctor continues to put you off work, regardless of the insurance company’s opinion.

Once you give the employer an updated sick note, it will trigger your rights to ongoing accommodations under employment and human rights laws. A reasonable accommodation is to allow you to continue on unpaid sick leave.

For more information, see Employment Rights and Disability Benefits.

3. Gather documents needed to plan your appeal

You need the information to understand the denial and to plan your appeal. We recommend you get the following documents:

- A denial letter from your claim representative

- A copy of your group insurance booklet, which describes your long term disability benefits

- A copy of the insurance company’s “claim file” (if your claim is more than six months old)

- Your union’s collective agreement (if applicable)

- A copy of your family doctor’s medical file, going back to when your symptoms started to affect your work

The purpose of these documents is to help with planning your appeal. However, your family doctor’s medical file also serves as proof of your claim. Make sure you keep a clean copy of the family doctor’s file to send to the insurance company.

4. Identify other benefits for which you may qualify

Even though your long term disability was denied, you may still qualify for other benefits. Also, the appeal can take months, so you need to work on a Plan B for other sources of income or financial support.

You may also qualify for employment insurance (EI) sickness benefits or creditor disability benefits on bank loans or credit cards.

5. Analyze the letter to identify the reasons for denial

Before you can plan your appeal strategy, you must first identify the insurance company’s reasons for denying you. Insurance companies are required to give reasons for why they denied long term disability coverage. They are supposed to put these reasons in writing for you.

At this step, you want to identify the reasons for your denial. We recommend that you write these out on a sheet of paper. At Resolute Legal, we track the reasons for denial in a table. Then for each reason for denial, you can identify possible responses and the evidence needed to refute the reason for denial.

This is the table we recommend using:

| Reason for Denial | Possible Responses | Evidence Needed |

|---|---|---|

Vague Reason for denial, but requests specific information and documents

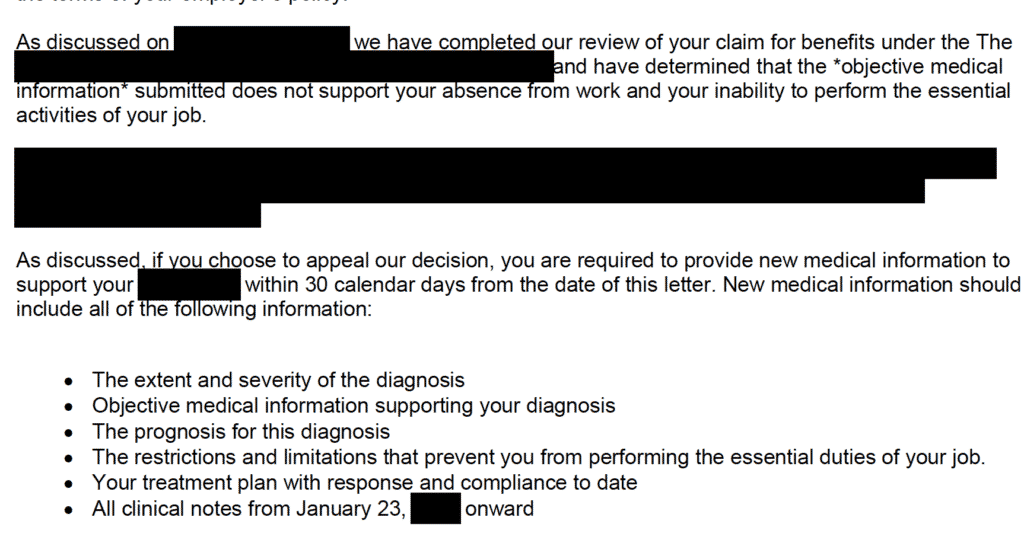

For example, here is the actual wording from a letter denying long term disability where the insurer’s reasons are vague, but they give specific recommendations for the documents needed on appeal:

This type of denial letter is helpful because it gives your doctor specific questions to address in a new medical report. It asks you to have your doctor clarify the extent and severity of the diagnosis, prognosis, and treatment plan. It also asks for a copy of the doctor’s file from a specific date forward.

You would add it to your table as follows:

| Reason for Denial | Possible Responses | Evidence Needed |

|---|---|---|

| “The objective medical information submitted does not support your absence from work and inability to perform the essential activities of your job.” | 1. Does the insurance policy require “objective” medical evidence | 1. medical report from doctor covering the following: extent and severity of diagnosis; objective medical information supporting diagnosis; prognosis; restrictions and limitations that prevent you from performing the essential duties of your job |

| 2. New medical records that document objective medical evidence | 2. family doctor’s clinical notes from Jan 23, 2020, onward | |

| 3. Functional capacity evaluation by an occupational therapist to document restrictions and limitations | 3. Clinical notes from any other health care provider from Jan 23, 2020, onward | |

| 4. Medical tests or evaluations to document objective medical evidence |

Vague reason for long term disability denial

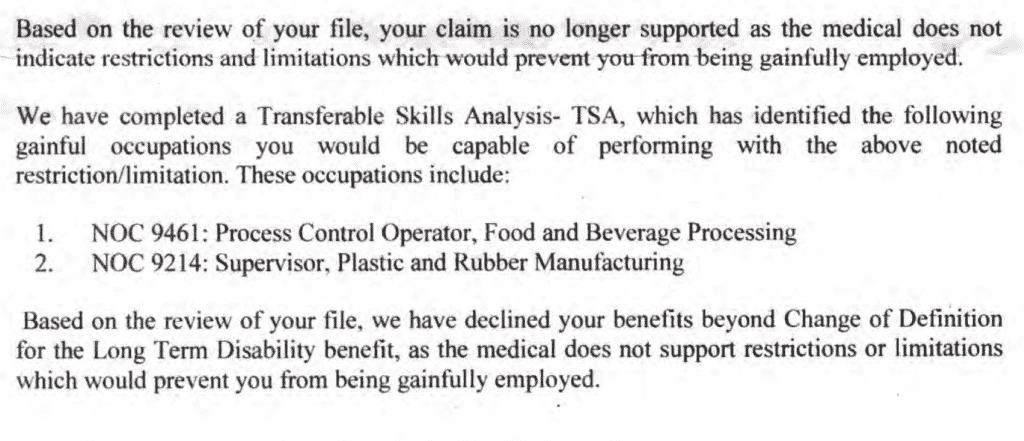

Here’s another example where the reason for denying long term disability is vague. However, the reference to the Transferable Skills Assessment gives you something to focus on:

In a situation like the one shown above, there is a clue about how you could focus your appeal. If I were advising a client, I would ask for a copy of the Transferable Skills Assessment (TSA). Then, you can look for ways to show it was based on flawed information, faulty assumptions, or poor judgment.

You could also get your doctor to review the TSA and offer a critique.

Or you could review the TSA and write a statement pointing out all the factual errors or flawed assumptions within the report. Often these TSAs are done without consulting you. So, they can be full of errors or factual mistakes.

You would add it to your table as follows:

| Reason for Denial | Possible Responses | Evidence Needed |

|---|---|---|

| We have completed a Transferrable Skills Analysis (TSA) which has identified the following gainful occupations you would be capable of performing with your current restrictions and limitations: 1) NOC 9461: Process Control Operator and 2) NOC 9214 | 1. Get medical evidence to show my restrictions and limitations are greater than the insurance company is saying | 1. Opinion letter from an occupational therapist or vocational rehabilitation expert |

| 2. Identify important factual errors in the TSA report that may have changed the writer’s opinion | 2. Get my own Functional Capacity Evaluation to show that my restrictions and limitations prevent me from doing the listed jobs | |

| 3. Identify missing information that may have changed the TSA writer’s opinion | 3. Get an expert review of the TSA to point out any errors in the report |

“No reason” long term disability denial

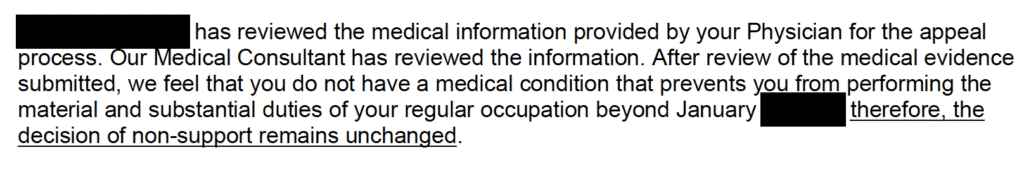

Finally, here’s an example of the worst reason for denial. I call it the “no-reason denial”:

As you can see, this letter provides no clear reasons for your long term disability denial. Therefore, there are no specifics for you to focus on in your appeal. The insurance company doesn’t say what gap in information led to the denial. However, this denial mentions another letter. So, I would start by looking for that letter to see if it has more specifics.

Another option is to ask the insurance company representative to give more detailed reasons. But keep in mind; they may not agree to that.

In a case like this, you may need to review the insurance company’s claim file to see what is really going on. Sometimes in a “no reason” denial situation, the insurance company has completely closed its mind to your claim. Your best option in this situation is often to move on and take your appeal to the court.

6. Identify documents needed to refute the disability claim denial

If you are lucky, the insurance company will give specific reasons for the denial and may even list particular documents or information they need to reconsider their decision. Specific reasons are helpful because they mention gaps in the information you submitted. This makes the appeal easier because you know exactly what information to get them.

You need to identify the best document(s) to refute each reason for denial. These could be documents that already exist (like past medical records), or they may be documents that need to be created (medical reports or new tests, examinations, and evaluations).

Identifying the right documents is difficult. It requires a lot of practice and experience. However, the insurance company’s reasons for denying long term disability often show a gap in the information or medical opinions provided. Ask yourself what document would fill that gap. Once you identify the document, you need to figure out how to get it.

For example, common gaps that need to be closed include the following:

- clarifying a medical diagnosis

- clarifying functional limitations

- explaining exactly how your symptoms and limitations prevent you from doing the job

- clarifying information about job requirements or physical demands

- providing copies of records or reports from other treatment providers

- obtaining new medical evidence

- obtaining information from co-workers or family members

- clarifying your work history

The best documents are going to come from medical providers or others. Documents you create are the least persuasive. You may be tempted to do your own research, attach medical information you found online, or prepare a written statement. However, these types of documents are not convincing to the insurance company. It is best to always focus on getting documents from medical experts like your family doctor and other treatment providers.

Best hack for how to appeal a long term disability denial

If you are representing yourself, here is a simple hack to get a medical report that has a chance of addressing the insurance company’s reasons. First, make a photocopy of the insurance company’s denial letter. Second, go through the letter and underline each reason for the denial. There are usually two to three different reasons given. Third, number each reason as 1, 2, 3 etc. Finally, give this copy of the letter to your doctor. Tell your doctor you need them to write a report that addresses the “reasons for denial” you have underlined and numbered in the letter.

This approach can work because you are giving your doctor specific things to address in their report. This route is much better than simply asking the doctor to write another report without giving them anything to go on — other than the fact that your long term disability claim was denied.

We recommend this hack over arranging for your own medical testing and functional capacity evaluations. We urge you to avoid doing that unless you are working with a disability lawyer. This type of evidence needs special care, and you could do more damage than good.

Step 7: Prepare and send your appeal letter

I find that this last step causes people the most anxiety. You may feel that if you don’t write a good appeal letter, it could result in your claim getting denied again.

Let me set your mind at ease. In the vast majority of cases, the long term disability denial appeal letter has almost no bearing on the decision. At this stage, the insurance company makes its decision based on the medical records and doctors’ opinions.

So, your appeal letter only needs to do three things: request the appeal, attach the required documents, and arrive at the insurance company before the deadline.

Ideally, you would review the key facts and then apply the law to show why they should approve your claim. But I recommend against trying this on your own. Writing this type of appeal letter is hard — especially if you don’t have experience.

You are better off avoiding legal analysis and focusing on writing about any information gaps. This could include:

- Clarifying any misunderstandings about your medical treatment or employment

- Reviewing all the things you did to try and stay at work

- Discussing how your symptoms affected your duties

Not sure how to set up your appeal letter? Check out our article on how to write an appeal letter (it also includes a long term disability appeal letter sample!)

Bonus Tip: Cover letter

Along with your appeal letter, you can also submit a cover letter. While this isn’t necessary, we encourage people to include one in their appeal. The reason for this is it can be used to summarize and organize all the important information. Your cover letter should be one or two pages maximum and should highlight all the key information and medical documents.

Once you have sent in your appeal and cover letter, you will usually get a response in 30 to 60 days. If there are delays, it’s likely because the insurance company is waiting for their doctors to review the medical information you sent in.

If your appeal gets denied, you may have to repeat this process until you have exhausted all internal appeals or have the right to go to the next level of appeal. This level could be an appeal hearing or a lawsuit. However, the rules that apply to you depend on your insurance policy and/or collective agreement.

Appealing long term disability denials externally (filing a lawsuit)

Now that you know how to do a long term disability appeal internally, let’s discuss external appeals, also known as a long term disability lawsuit. External means that the appeal is handled by someone independent of the insurance company. In most cases, this will be a judge in your province. However, some plans have different procedures. So, it could be an arbitrator.

When you do an external appeal, it can involve filing a lawsuit against the insurance company. However, this is still an external appeal. So, the insurance company can decide to approve your claim before it gets to court.

With external appeals, there is generally more risk, but with that comes greater rewards. In our experience, people tend to have more success at this stage than at the initial internal appeal level. However, external appeals require more expertise as you will have to present your arguments in front of a judge or arbitrator. There is also more risk at this level, given you may be ordered to pay the insurance company’s legal fees if you lose.

All in all, it is likely in your best interest to hire a lawyer or advocate if you’re considering moving forward with an external appeal.

Click on the button below to schedule a free consultation with our experienced team.

When to use this method

In most cases, external appeals are the most effective way to appeal a long term disability denial. Oftentimes, you need a fresh set of eyes and an outside, unbiased perspective to get a favourable decision. Think about it. The insurance company and the people working for them want to deny as many claims as possible. So, if an insurer has already denied your claim, it’s unlikely they will willingly approve it.

That’s why external appeals are so effective. They leave the decision up to someone else instead of the insurance company.

So, when does it make sense to do an external appeal?

- You have tried one or more rounds of internal appeals and were denied

- You are running out of time to file a lawsuit

- You are at the two-year change of definition mark of your disability claim

- You failed to follow through on a medical examination, vocational assessment, or rehabilitation program

- Your denial involves unfavourable surveillance video of you engaging in activities you said you were unable to do

- The insurance company has spent a lot of money on your claim (i.e., sent you in for an independent medical examination, treatment, or video surveillance)

- Your denial cites technical reasons, like a pre-existing condition or late application.

- The provider blames your inability to work on your employer (a toxic work environment or insufficient accommodations for your disability.)

- You are running out of time and money

As you can see, the reasons you should move forward with an external appeal mirror the reasons you should NOT do an internal appeal. The same can be said for the reasons for avoiding this method.

Further reading: Long term disability mediations

When to avoid this method

You should avoid an external appeal and try an internal one if any of the following situations apply:

- The provider denied your initial claim because they needed clarification from your doctor.

- You failed to provide the requested information.

- You refused a particular treatment or appointment when you submitted the claim, but now you have.

- Your doctor provided incomplete or vague information.

- The provider’s doctor hasn’t evaluated you yet.

- The provider has no surveillance of your daily activities.

- The provider has yet to spend much money or time on your claim.

While there are some situations when an internal appeal makes the most sense, it’s important to note that these types of appeals are rarely effective. In our experience, insurance companies are very unlikely to approve a claim unless you opt for an external appeal/ lawsuit.

Three mistakes to avoid with your long term disability appeal

Appealing a long-term disability (LTD) denial can be a stressful and overwhelming process. However, even the smallest missteps could significantly affect the outcome of your appeal. Below, we cover three common mistakes claimants make during their LTD appeal and how to avoid them to give your appeal the best chance of success.

1. Missing deadlines

The most critical mistake you can make is missing the deadline to file your appeal. Insurance companies often have strict deadlines for submitting appeals, and missing these dates could mean forfeiting your right to challenge the denial. Pay close attention to the timeline outlined in your denial letter, and ensure you submit all necessary documents on time. It’s a good idea to set reminders or even consult with a lawyer to ensure everything is filed within the allotted period.

2. Failing to address the insurer’s reasons for denial

One of the most common reasons appeals fail is because claimants don’t adequately address the specific reasons the insurance company provided for denying their claim. Simply submitting the same documents from your original application without refuting the insurer’s reasons will likely lead to another denial. Review the denial letter carefully and respond with updated medical evidence, detailed reports from your doctors, and any additional information that challenges the insurer’s decision.

3. Overlooking legal advice

Navigating an LTD appeal on your own can be challenging, especially if legal or policy-specific issues are involved. Many claimants make the mistake of assuming they can handle the appeal without legal guidance, but this can lead to costly errors. Insurance policies are often complex, and a lawyer can help identify potential pitfalls and guide you on how best to strengthen your case. Even a brief consultation can make a big difference in the outcome of your appeal.

Avoiding these mistakes can greatly improve your chances of overturning an LTD denial and getting the benefits you deserve. Keep these points in mind as you work through the appeals process, and don’t hesitate to seek help if needed.

We can help if you have had your long term disability denied!

If you need denied long term disability help our long term disability lawyers at Resolute Legal have accumulated years of experience handling long term disability claim appeals.

We have developed a reputation among insurance companies as one of the most tenacious disability law firms in Canada. For that reason, we are more likely to win back the benefits you deserve. So, let us help you get back the money you are rightfully owed. Get started today. Call (888) 480-9050 for a free case evaluation, or click on the button below to schedule your free appointment.

FAQs

Can an employer deny long term disability?

Yes. An employee can be denied LTD benefits for several reasons. In most cases, providers deny claims on the grounds that you don’t meet the policy’s definition of disability. However, a denial doesn’t necessarily mean you don’t qualify. Always contact a disability lawyer if you believe you were wrongfully denied.

Why would I be denied long term disability insurance?

Benefit providers will cite a wide variety of reasons for why they are denying your claim. The most common reasons are you are not getting regular care from a family doctor, you are failing to participate in recommended treatment(s), and your doctor isn’t providing or documenting your treatment.

Insurance companies will also cite things like “lack of objective medical evidence” and “does not meet the definition of disability.”

How often are LTD claims denied?

Insurance companies rarely share statistics on how many claims they deny each year. However, some sources suggest that in Ontario, up to 60% of long term disability applications are denied. Keep in mind that statistic is unverifiable, and insurers could deny more or less than the aforementioned amount.

Can my LTD insurance company force me to go back to work?

An insurance company can’t force you to return to work. However, they can pressure you to return by threatening to cut you off. It’s often best to attempt to go back. However, if you are unable safely return and the insurance company continues to pressure you, contact us immediately.

Next Step: Download Our Free Book

Learn more by downloading our free book on long term disability claims in Canada. Chapter 4 covers how to prepare a winning appeal for long term disability benefits. Click on the image below.

Originally published on June 13, 2021