We regularly receive questions about various provincial disability benefits. Currently, we do not represent people in applications or appeals for these types of benefits. However, our goal is to empower Canadians with education in order to help them win the disability benefits they deserve. We want to educate on these matters as best as we can. Today, I will be answering 5 common questions that we receive about ODSP eligibility.

What is ODSP?

The Ontario Disability Support Program (ODSP) is a government-funded disability benefit for residents of Ontario. This provincial disability benefit is for those who are over 18, suffer from a disability, and are in need of income support.

ODSP and Ontario Works are two main components of Ontario’s social assistance system. The Ontario Disability Support Program can help provide financial support for food and housing, as well as assist with medical coverage for drugs and vision care.

Do I Qualify for ODSP?

Like with all disability benefits, you need to meet certain criteria to be eligible for ODSP. The most basic eligibility factors are that you must be a resident of Ontario and over the age of 18.

The Ontario Disability Support Program further breaks their eligibility into two final categories: financial need, and being a person with a disability.

When you begin your application, you will be assigned an ODSP caseworker that will determine your eligibility on the basis of financial need. Essentially, this factor comes down to your household’s basic living expenses being higher than your household income. It is important to note that this doesn’t just mean your income and your expenses. They will take into account the entire household.

For the purposes of eligibility, a person with a disability is someone who has a mental or physical impairment that is continuous or recurrent and is expected to last longer than a year. This impairment has to restrict the person’s ability to work, take care of themselves, or take part in community work such as volunteering.

You can look into applying for Ontario Works if your disability won’t last longer than a year.

Do I have to qualify for social assistance?

ODSP is a type of social assistance. So, you need to qualify under the same rules for social assistance to be able to collect the ODSP.

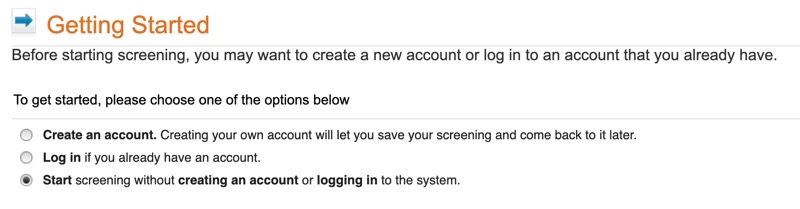

If you aren’t entirely sure if you qualify, they do have an application service online where you can do a quick survey to determine if you meet the financial requirements. I went through the steps to test it — you don’t even have to set up an account. It only takes about 10 minutes.

They ask general questions about yourself, household, assets, income, and expenses. At the end they will let you know if you qualify for financial assistance based on the information provided. All the information entered during this screening can be used to begin your application if you find that you qualify.

How to Apply for ODSP?

You can apply for ODSP a few different ways. You can visit an ODSP office, call the office and begin the application process over the phone, or you can apply online after completing the survey above.

The first step in the application process is filling out the initial paperwork. This includes information about you and all family members living in your household; housing costs, income information, and tax information as well. Within 5 business days, the office will contact you to schedule an in-person meeting.

During the appointment with an ODSP support worker, they will collect more information from you. It will be more specific about your family members; children and information about the children; where you live and the cost of rent; your family’s annual income; any additional income you may be receiving; and any assets you or your family own.

You should have the following documents available in case the social worker needs to see them:

- birth certificates

- immigration papers

- Social Insurance Numbers (SIN)

- Ontario health card numbers (OHIP)

- documents about your housing costs, income, and other assets

The caseworker will also have additional paperwork for you to review and sign. Within 15 days of your meeting with the caseworker, they will issue a decision about whether or not you meet the financial requirements. If you do, they will send out a package called the Disability Determination Package to determine if you meet the disability requirements.

ODSP Disability Determination Package

There are 6 parts in this package:

- Health Status Report

- Activities of Daily Living Index

- Consent to the Release of Medical Information

- Self Report

- Instruction sheet

- Addressed envelope

You are responsible for filling out and signing the consent form and Self Report.

A medical professional should fill out the Health Status Report and the Activities of Daily Living Index.

Just like the application for CPP disability benefits, you will want to include supporting medical evidence as well. You can attach documents such as medical charts, hospital records, functional assessments —really anything that supports your disability claim.

Can I Collect Both ODSP and CPPD?

The simple answer is yes, you can collect both ODSP and CPP disability benefits.

If you are approved for CPP disability when you apply for ODSP, they actually put you in something called a “prescribed class.” As part of a prescribed class, you don’t need to submit a Disability Determination Package. If you receive CPP disability benefits, you are already qualified to collect ODSP — at least from a medical perspective. In this case, you just need to pass the financial eligibility for ODSP to get approved.

If you’re approved for both, ODSP will offset what you receive from CPP disability benefits, including the retroactive payment. This means you won’t necessarily get more money each month.

But, there are advantages to collecting each benefit. If you are collecting CPP disability, you won’t end up taking a drop for your regular CPP pension payments at age 65. Collecting the ODSP can help with financial aid and give you medical benefits to help pay for prescriptions and more. This is something that CPP disability benefits don’t offer.

Each provincial disability program may offset CPP disability payments differently. You should contact ODSP if you are approved for CPP disability benefits. Before spending the retroactive payment from CPP disability, you will want to pay ODSP the amount of the offset you will owe to prevent future problems.

Free Books

Subscribe to our email newsletter and and will email you FREE PDF copies of our books for winning CPP disability, short-term disability and long-term disability.