The change of definition for long-term disability is when the criteria for disability benefits moves from one definition to another. This change makes it more difficult for you to continue to get long-term disability benefits. In this article, I explain the change of definition and how it affects your long-term disability benefits.

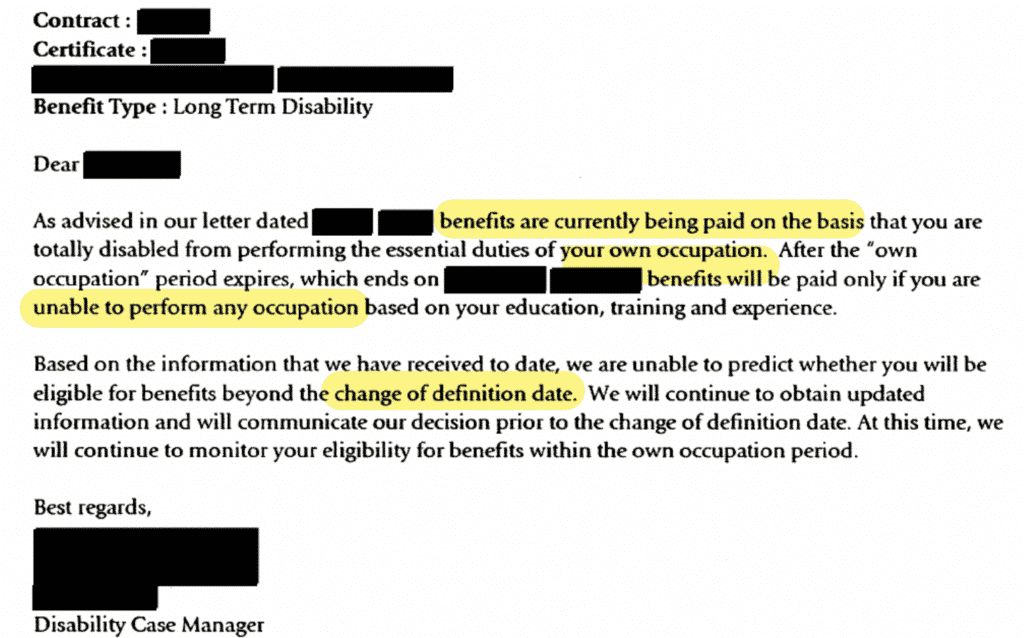

Most people first learn about the ‘change of definition’ of disability upon getting a letter from the insurance company. This can happen early in your claim approval letter. Or it can happen later, when you are in the year leading up to the change of definition.

Change of definition LTD example

Here is an example of what one of these change of definition LTD letters looks like:

As you can see, this letter warns you of the upcoming ‘change of definition’ of disability. The definition changes from being unable to do “own occupation” to being unable to do “any occupation.” Generally speaking, it is easier to prove you can’t do the essential duties of your own occupation than it is to prove you can’t do the essential duties of any occupation.

For example, I am a lawyer. Believe it or not, the essential duties of being a lawyer are tough! Especially the mental demands and stress. So, it is easier for me to prove a disability prevents me from doing the duties of a lawyer than it is to prove I can’t do any other job. One that is easier than being a lawyer. With less mental demands, stress, etc.

What is the Definition of Total Disability?

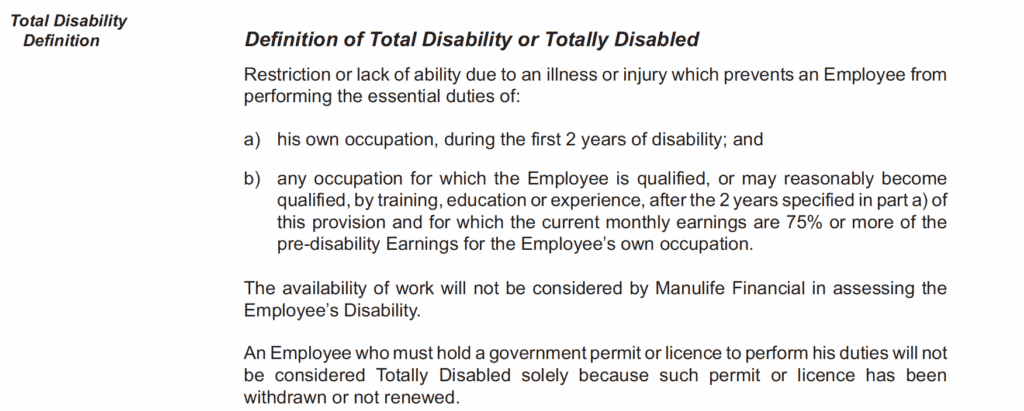

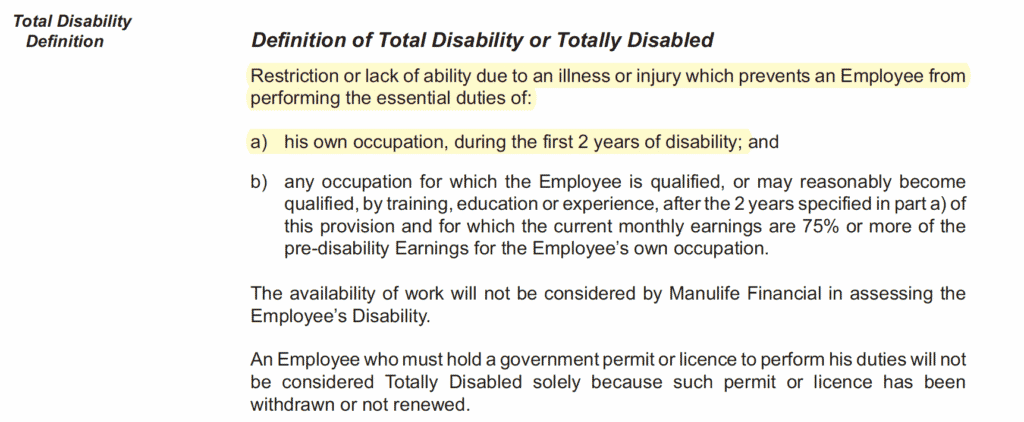

Most long-term disability policies have a two-part definition of “total disability” that includes both the “own occupation” and “any occupation” criteria. Here is a typical example:

Own Occupation: Before the Change of Definition

The own occupation definition of disability usually applies for the first two years. Own occupation is not always defined in the policy, but it refers to the employment you had at the time you became unable to work because of disability. It is not your specific job with your employer, rather, it means your occupation in general with your employer or any other employer.

In this example, you would qualify for long-term disability benefits, for two years, if you can prove that — due to an illness or injury — you can’t perform the essential duties of your own occupation.

Any Occupation: After the Change of Definition

The any occupation definition of disability is more nuanced than own occupation. The courts have not given a literal interpretation to his clause. There are two things to know:

First, “any” occupation does not literally refer to all possible occupations. As you can see in the above example (part b), it has to be an occupation in which you could earn at least 75% of your pre-disability earnings. Please note, most policies DO NOT include a reference to a percentage of pre-disability earnings. Most are silent on this. This makes it more difficult to determine if you meet the criteria for disability from any occupation. Even without a reference to a percentage, some judges will interpret any occupation clauses to mean at least 60% of your pre-disability earnings, but not always.

Second, the “any occupation” definition refers to occupations that you may “reasonably become qualified by training, education or experience.” The younger you are, the more likely it is the insurance company will argue that you are capable of retaining that would enable you to earn 75% or more of your pre-disability earnings. It is rare for insurance companies to pay for you to be retrained, but it can happen sometimes. Most often, they will just assert that you already have the skills needed to do jobs that qualify under the “any occupation” clause.

For more information on your own and any occupation, check out our article: Disability Insurance: Own Occupation vs Any Occupation.

What Happens in the Months Leading up to the Change of Definition?

In the months leading up to the change of definition, the insurance company will gather information about you. They will seek updates from your doctor and other treatment providers. They may arrange for you to undergo vocational or medical assessments. Sometimes you will attend these assessments, but other times they do it behind the scenes without you seeing anyone. Examples of behind-the-scenes reports include transferrable skills assessments and internal medical reviews by insurance company doctors.

As you get closer to the change of definition date, the insurance company will notify you if your claim ends. Unfortunately, insurance companies will wrongfully deny many long-term disability claims at the change of definition. It is a convenient time for them to do so.

If the insurance company denies your claim in this way, don’t simply accept it. Remember, any occupation doesn’t mean all possible occupations. This is a nuanced definition and you should seek advice from an experienced disability lawyer. Even if you are considering a return to work, it may be in your best interests to appeal the decision just in case your return to work fails.

Looking for more information on long-term disability in Canada? Check out our Ultimate Guide to Long-Term Disability.

Take the Next Step – Get Your Free Book