Have you applied for early CPP retirement and are wondering if you should have applied for CPP disability instead? Are you getting CPP early retirement payments and want to know if you can switch over to CPP disability? If so, you’re definitely not alone!

As a member of the support team at Resolute Legal, I have spoken with hundreds of people about CPP disability claims, and this is one of the most common questions I get. I wrote this article to explain what you need to know before converting from a CPP retirement pension to a CPP disability pension.

This article is part of our Ultimate Guide to CPP Disability.

The difference between CPP retirement pension and CPP disability benefits

Before we dive into anything else, let me explain the difference between CPP retirement pension and CPP disability benefits.

CPP retirement pension is probably what you think of when you hear “CPP.” The CPP retirement pension refers to the monthly payment you receive after you retire. The standard age that people apply to receive this money is 65. However, if you are eligible, you can apply any time between the ages of 60 and 70. The age that you begin receiving your retirement pension directly affects how much money you receive. If you apply to start receiving this money at age 60, for example, you will receive less money per month than if you applied at age 65.

In this article, when I talk about an early CPP retirement pension, I am referring to those situations when a person has applied for their retirement before they are 65.

CPP disability benefits can refer to either the CPP disability pension or the post-retirement disability benefit. The CPP disability pension refers to the monthly payment you receive if you are disabled and unable to work. The term “pension” can be a bit confusing because people usually think of an old-age retirement pension. In this case, people who receive the disability pension have “retired” from work due to severe and prolonged disability. Just as with the CPP retirement pension, you must apply for the CPP disability pension.

The post-retirement disability benefit is a monthly payment for individuals who are disabled but are disqualified from receiving the disability pension because they have been receiving an early retirement pension for more than 15 months. This benefit is a flat rate that gets paid in addition to the retirement pension. I will explain this in more detail later in this article.

Why should I convert my CPP early retirement pension to a CPP disability pension?

If you are disabled, unable to work, and you meet the criteria for CPP disability benefits, it’s always a good idea to apply. If you happen to be under the age of 65 and already receiving your CPP retirement pension, there are a few reasons you may want to switch over to a CPP disability pension instead.

The main reason is one that a lot of people love to hear: you will receive more money.

When you take an early retirement pension, it is paid at a reduced rate. If you are approved for CPP disability benefits, however, you will receive a different amount. Both the average monthly amount and the maximum amount received for CPP disability are higher than the CPP retirement pension. You can’t collect both pensions at the same time — so why not choose the one that will help you more? It is almost always a better financial decision to take a disability pension instead of an early retirement pension. But we recommend speaking with a financial advisor if you have a more complex situation (pensions other than CPP, etc.)

To learn more about how to calculate your CPP disability pension amount, check out our article:

CPP Disability Payment Amounts: How to Know How Much You Get [+Video].

Additionally, when you receive a CPP disability pension in the years leading up to age 65, it counts as income — the same as if you were working. This means that you aren’t penalized for periods of low or no income. In contrast, with a CPP retirement pension, you are penalized for not contributing due to your years out of the workforce.

When you turn 65, your disability pension automatically converts to a regular CPP retirement pension. And when this happens, you haven’t lost out by getting the early retirement reduced rate.

Am I eligible to convert from a CPP retirement pension to the CPP disability pension?

You are eligible to convert from a CPP retirement pension to a CPP disability pension if you:

- Meet the eligibility criteria for CPP disability pension, and

- Have been getting CPP retirement for less than 15 months (the 15-month rule)

CPP disability eligibility criteria

To qualify for a CPP disability pension, you must:

- Be between the ages of 18-65

- Have made contributions to CPP for 4 out of the last six years,

or 3 out of the last six if you have over 25 years of total contributions - Have a disability that is both “severe and prolonged.”

Here, severe means that you have a mental or physical disability that regularly stops you from doing any type of substantially gainful work. Prolonged means that your disability is long-term and is either of indefinite duration or is likely to result in death.

The 15-month rule

What is it?

Essentially, the 15-month rule is that if you have been receiving your regular CPP retirement benefit for more than 15 months, you are no longer eligible to receive the CPP disability benefit.

If you have applied for and received your regular CPP retirement benefit and you wish to switch over to a CPP disability pension, you must get your application submitted to Service Canada. You must do this before you have been receiving the regular CPP retirement pension for 15 months.

Are there exceptions?

This rule is extremely strict. If you apply even one day past the deadline, they will deny your claim and continue to deny it through all levels of appeal.

Maybe you didn’t know the CPP disability benefit was an option, you weren’t disabled when you took your early CPP retirement, or you mailed the application before the 15 months, but it wasn’t received until after. Even if you have an explanation for why you missed the deadline, the decision will not be reversed.

How do I know if I am within 15 months?

The date that 15 months begins is the date of your first retirement pension payment.

So, if you were issued your first cheque or direct deposit for your CPP retirement pension on October 29, 2019, this is the date you would begin counting from. Fifteen months is quite a lot to count. So if you’d prefer an easier route, timeanddate.com has an excellent date-add function.

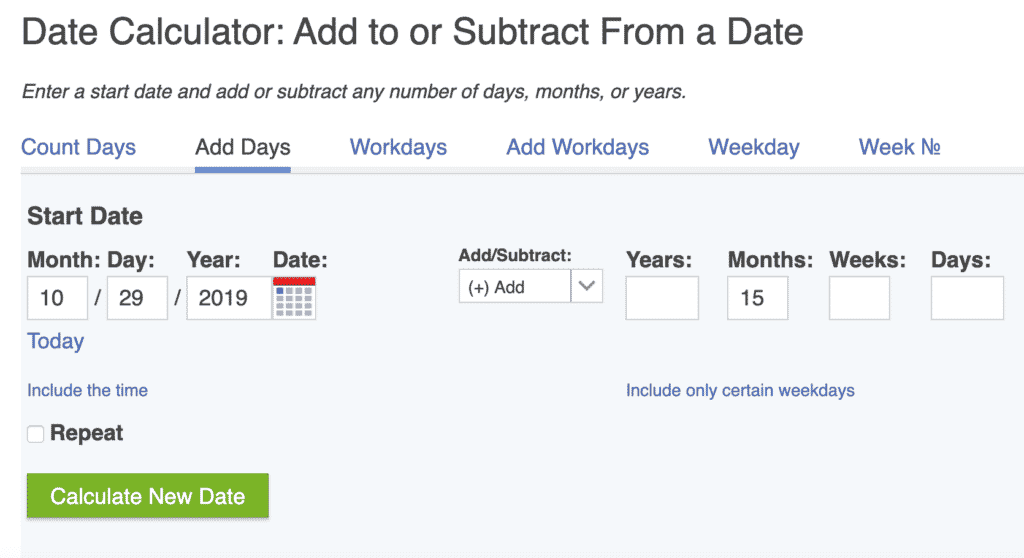

Using the link above, go to their site and input your start date — October 29, 2019, for this example. Choose “Add” and input 15 into the “Months” box.

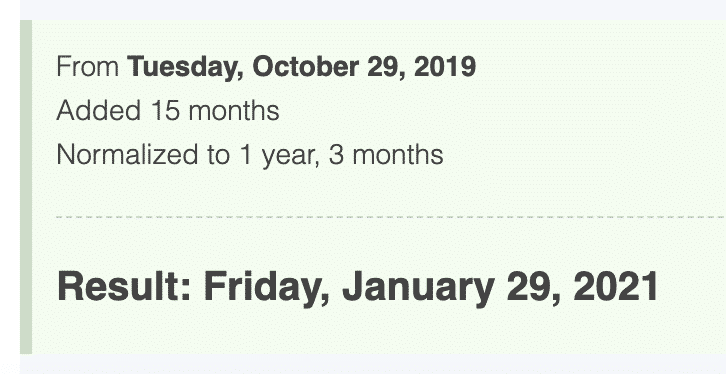

Once you do this, click “Calculate New Date,” and it will do the hard work for you. As you can see, the result, in this case, is January 29, 2021.

If you think that you have been receiving your CPP retirement pension for very close to 15 months already, it may be best to call Service Canada and ask them for the exact date that you were approved and use that for your calculation.

How do I apply to convert my CPP retirement pension to a CPP disability pension?

If you have determined that you are eligible for a CPP disability pension and you are within 15 months of receiving a CPP retirement pension, your next steps are pretty simple. You have to file your CPP disability application. The key is to apply before the 15-month deadline. If you need more information about the application process, we have an article to guide you through: How to Apply for CPP Disability Benefits.

It can be smart to apply for both pensions at the same time. In fact, Service Canada brings the possibility to your attention on the regular pension application form. If you apply for both at the same time, the early pension will most likely be approved while waiting for the decision on the disability benefits. If you are in need of some income, this is a good strategy. You can collect your CPP retirement pension while going through the application process for a CPP disability pension.

In the event that your CPP disability application is denied because you don’t meet the eligibility criteria, you can still apply for a CPP pension after — or continue to receive your payments if you applied at the same time.

And finally, if you don’t meet the criteria to convert from your CPP retirement pension over to a CPP disability pension, there is a chance you still qualify for the new post-retirement disability benefit.

CPP post-retirement disability benefit

What is it?

The Post-Retirement Disability Benefit is a new benefit that has only been available since January 2019. It was put in place for people who were found to be disabled but aren’t qualified for the CPP disability pension because they have been collecting their early CPP retirement for more than 15 months.

The benefit is only for people who are under 65 and receiving an early pension with a minimum qualifying period (MQP) that extends into January 2019. This means that you would still be working and contributing to CPP but have applied for and are receiving an early CPP retirement pension as well. Your minimum qualifying period has to extend to the date of your application; there is no late application provision under the post-retirement disability benefit.

How much can you get?

This benefit works as a top-up to your regular CPP retirement pension. You will continue receiving your pension payments; if you are approved, you will also get this payment.

The amount of this benefit is equal to the flat rate in the CPP disability calculation. As of October 2019, this amount is $496.36 per month. That amount will be paid until age 65. When you turn 65, the disability payment stops, but the retirement pension remains.

Since this benefit was newly introduced in January 2019, any retroactive payments will not go further back than that date.

How to qualify

The eligibility criteria for the post-retirement disability benefit are the same as those for the CPP disability benefit. You must be between the ages of 18-65; you must have contributed to CPP for 4 out of the last six years or 3 out of the last six if you have over 25 years of total contributions, and your disability must be severe and prolonged.

How to apply

There is no separate application process for this benefit. You complete the same forms for CPP disability benefits. If you aren’t eligible to receive a CPP disability pension, you will automatically be considered for post-retirement disability benefits.

Next step – Get your free book

Start making better decisions today. Click on the image below to request an instant download of our free book.