Have you begun your application for CPP disability benefits and are wondering how much money you will receive? Have you already received a retroactive payment for CPP disability and don’t understand or agree with the amount? In this article, I will explain the CPP disability retroactive payment.

This aspect of CPP disability is confusing — not to mention all of the conflicting explanations you can find online. So, I am going to explain how it all works. Here are the top 9 questions that our clients ask about the CPP disability retroactive payment.

This article is part of our ultimate guide on CPP disability payments.

1. What is the CPP disability retroactive payment?

The CPP disability retroactive benefit is a one-time payment you get shortly after you get CPP disability benefits. This payment represents several months (or even years) of past CPP disability payments that you were eligible for before your application was approved. Once Service Canada approves your application, you will receive a one-time payment for the retroactive benefit. Then, you receive monthly benefit payments going forward.

2. How to apply for retroactive CPP payments

Service Canada automatically assesses your eligibility for CPP retroactive payments during the approval process. You don’t need to submit a separate request. Almost everyone who qualifies for CPP disability also qualifies for a retroactive payment. The amount of the retroactive payment can vary greatly from person to person.

The longer Service Canada takes to approve your claim, the more retroactive benefits they will owe you.

There is only one way you wouldn’t qualify for a retroactive payment. This happens if you apply for CPP disability the same month you become disabled and get approved immediately at the end of the minimum 4-month waiting period. This rarely happens unless you have a terminal illness that requires an expedited assessment.

3. What happens when you get approved for CPP retroactive payment?

If Service Canada approves you for retroactive payment, you will get a letter in the mail. It contains a Payment Explanation Statement. There’s also a tax information sheet that explains how to notify Revenue Canada about the payment. The Payment Explanation Statement sets out the amount of the retroactive payment.

It also shows the months and years that make up the payment.

Here is an example of the exact letter you will receive:

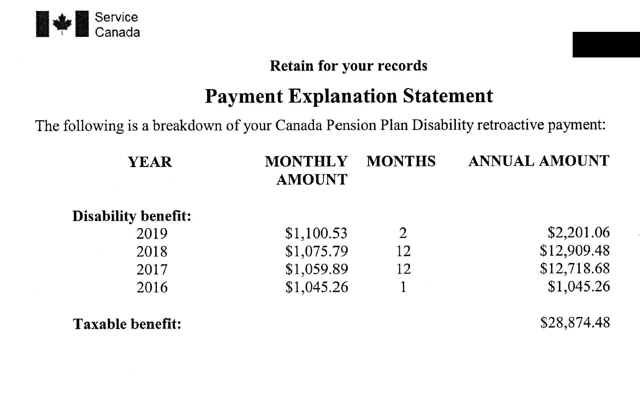

An example of the Payment Explanation Statement:

You can see from this Payment Explanation Statement that the person received a cpp disability retroactive lump sum payment of $28,874.48. This payment was retroactive to December 2016. So, the period of the retroactive payment was twenty-seven months, from December 2016 (start date) to February 2019 (approval date).

You can also see the original monthly benefit amount was $1,045.26 in 2016. It increases each year because of inflation indexing.

Have questions about your CPP retroactive payment or need help understanding your Payment Explanation Statement? Reach out to us today for clear answers and personalized support!

4. Is the CPP disability back payment taxable as income?

The CPP retroactive payment is taxable as income. Depending on the amount of back pay and the months or years of benefits it represents, you can be taxed on the total amount in the year you receive it. Or, it can be spread out over two or more tax years.

If you receive a retroactive payment that covers more than one tax year, then you should advise Revenue Canada. This is so they can spread the large payment over those two years. That will generally result in you paying less in taxes overall. If you don’t make this request to Revenue Canada, then they can tax you on the entire amount in the year you receive it. That can put you in a higher tax bracket and result in more taxes owing than if you spread it over two or more years.

Service Canada also provides you with a Tax Information Sheet. This tax sheet has all the information you need. It tells you how to notify Service Canada about the retroactive payment and how it should be spread over more than one tax year.

5. How is the CPP disability back payment amount calculated?

It is difficult to explain how the payment is calculated. When you read about it online, you will see references to the fact that retroactive payment is limited. Usually, you will see a timeline of 15 months, 12 months, or 11 months. It gets confusing quickly.

References to 11, 12, or 15 months refer to when the retroactive payment can start for a given person. Those are not references to the size of the retroactive payment. Once you know the start date of the retroactive payment, then benefits will be owed from that date to the date your claim is approved. So, the total size of the retroactive payment can represent years of back payments if your claim takes over a year to get approved.

CPP disability retroactive payment dates

The start date for your CPP disability retroactive benefit is the date you applied for CPP disability. To be more specific, the date you applied for CPP disability is the date Service Canada deems your application “complete.” Service Canada deems your application complete when they receive the completed originals of both your application form and the official medical report form.

Once you know your application date, you can figure out the start date for your retroactive benefit payment, which will be 12 months before this. The start date for calculating the retroactive payment can never exceed 12 months before your application date.

However, the start date might be less than 12 months. This is if the date of onset of your disability was less than 15 months before your application date. This is because the 12-month maximum is based on the fact that your disability onset date is 15 (or more) months before your application.

So, if your disability onset date is 15 months or more before your application date, then you would add a four-month waiting period. Your retroactive benefit start date would begin after the four-month waiting period.

For example, if your disability onset date was 14 months before your application date, then the start date for retroactive benefits would be 11 months before the application date.

Your total retroactive benefit is from that start date until the date of approval.

6. What if I disagree with my retroactive payment amount?

The retroactive payment amount is not negotiable. This is because it is based on your application date and your date of disability onset. The only way to increase the size of the retroactive payment amount is to challenge Service Canada’s choice of application date and/or disability onset date.

The application date is hard to challenge unless you can prove they had the full application sooner than they are saying they did. It is easier to challenge the disability onset date, but often, this is not a limiting factor in calculating the retroactive payment. If the onset date is the limiting factor, it is sometimes possible to prove that your onset date was earlier than 15 months before your application. However, before you try to change your disability onset date, make sure that you will not create other problems by moving your disability date outside of your minimum qualifying period. If that happens, then you can entirely disentitle yourself to CPP disability benefits. I urge you to seek advice from a professional before taking steps to challenge your disability onset date.

7. Can an insurance company or government agency take the back payment?

Yes — the CPP retroactive payment is subject to garnishment or seizure by insurance companies, provincial agencies, and the federal government. This can only happen if you sign a form authorizing the insurance company or government agency to get reimbursed. In fact, I have written an article about one of the situations where this happens:

8. What If I disagree with my retroactive payment amount?

The retroactive payment amount is not negotiable. This is because it is based on your application date and your date of disability onset. The only way to increase the size of the retroactive payment amount is to challenge Service Canada’s choice of application date and/or disability onset date.

The application date is hard to challenge unless you can prove they had the full application sooner than they are saying they did. It is easier to challenge the disability onset date, but often, this is not a limiting factor in calculating the retroactive payment. If the onset date is the limiting factor, it is sometimes possible to prove that your onset date was earlier than 15 months before your application. However, before you try to change your disability onset date, make sure that you will not create other problems by moving your disability date outside of your minimum qualifying period. If that happens, then you can entirely disentitle yourself to CPP disability benefits. I urge you to seek advice from a professional before taking steps to challenge your disability onset date.

9. Can an insurance company or government agency take the back payment?

Yes — the CPP retroactive payment is subject to garnishment or seizure by insurance companies, provincial agencies, and the federal government. This can only happen if you sign a form authorizing the insurance company or government agency to get reimbursed. In fact, I have written an article about one of the situations where this happens: consent to deduction and payment CPP.

It can also happen if the federal government has obtained a garnishment order against you. This can happen if you owe money for EI benefits or taxes.

It can also happen if the federal government has obtained a garnishment order against you. This can happen if you owe money for EI benefits or taxes.

Key takeaways on CPP disability back pay in Canada

- What are CPP disability retroactive payments? It’s a one-time payment covering past CPP disability benefits owed before your application was approved.

- Eligibility for retroactive payments: Most applicants qualify, except those approved immediately after the minimum waiting period (rare cases like terminal illness).

- Approval and notification: Once approved, you’ll receive a Payment Explanation Statement detailing the retroactive payment amount and the period it covers.

- Retroactive payment calculation: The payment amount depends on the time between your disability onset, application date, and approval.

- Tax implications: Retroactive payments are taxable but can be spread across multiple years to reduce tax burden. Notify Revenue Canada to arrange this.

- Disputing your payment amount: Payment amounts are non-negotiable unless you can prove errors in your application or disability onset dates. Seek professional advice before disputing.

- Potential garnishments: Retroactive payments may be garnished by insurance companies or government agencies if you’ve authorized reimbursement or owe debts like EI or taxes.

- Consult professionals: If you’re unsure about your payment amount, tax implications, or garnishment, consult a lawyer or financial advisor for guidance.

Need help with your CPP disability claim? Contact us today for a free consultation!

Next Step – Get Your Free Book

Start making better decisions today. Click on the image below to request an instant download of our free Book.