If you have been approved for long-term disability, there will come a time when the insurance company asks you to fill out an ‘update form.’ These forms come in many shapes and sizes. Some are perfectly fine, while others contain traps for the unwary.

Before I get into the traps, it is important to know that you have a duty to keep the insurance company informed about your situation. In particular, you must tell them if your medical condition improves if you are getting new treatment, if you plan to travel internationally, or if you have regained some capacity to work. So, Insurance companies use ‘update forms’ as a way to collect this information from you.

It is in your best interest to cooperate with the insurance company. Usually, filling out these forms is in your best interests — but there are limits. Sometimes the forms are designed to make you compromise your legitimate disability claim. Let’s look at the most common long-term disability update form traps you need to avoid.

For more information on long-term disability claims, check out our Ultimate Guide to Long-Term Disability in Canada.

The Surveillance Trap

I remember the first time I saw the surveillance trap in action. My client received a questionnaire from the insurance company. It asked about her activities both in and outside of her home. One question asked how often she went outside. My client replied that she hardly ever went outside, which is honestly how she felt. She used to be very active and had withdrawn from her volunteer work and other activities.

Unknown to my client, the insurance company had arranged for a private investigator to do video surveillance of her two weeks after she received the form. They had her on video leaving the house twice in one week and four times the next week. A few weeks later, the insurance company sent her a letter terminating her long-term disability benefits because surveillance had shown she was much more active outside the home than she had said. The letter noted “inconsistencies” between the video and the questionnaire. They were calling her a liar without coming right out and saying it.

Since then, I have seen this same trap dozens of times. You will know this trap is being set for you if 1) You are on an approved long-term disability claim; 2) The insurance company sends you a questionnaire seemingly out of the blue; and 3) the questionnaire asks for details about your daily activities, involvement in the community and activity on social media.

Solution: You need to be extremely careful filling out these activity questionnaires. Be accurate when describing your abilities. For most people, this means describing ranges of abilities and what you can do on good days and bad days. Don’t allow them to force you into checking one box. This is a trap to prevent you from giving a range of abilities. You should always describe the range of good and bad (if that applies to you). Avoid using the words “always, never, etc…). Write in the margins of the form. Or attach another page if necessary.

The Under-the-Radar-Authorization Trap

The next trap is more despicable, in my opinion. I call it the under-the-radar authorization trap. Rather than just getting an update from you (which is legitimate), some insurance companies will try to sneak in a general authorization form. They will include this at the bottom of the questionnaire and make it seem like you must sign it. A general authorization is one that gives them broad power to receive and disclose your personal information to a broad range of people and organizations, including any doctor, any hospital, the government and your employer! Once you sign this, you don’t know who they may contact or share your information with.

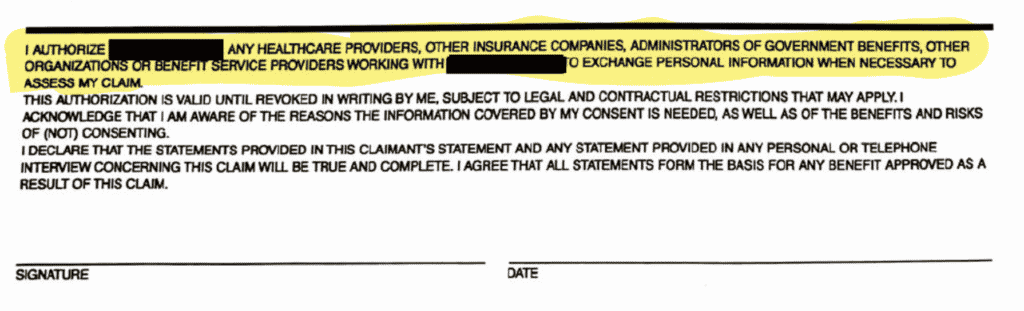

Here is a typical example of a broad authorization tacked on to the bottom of an ‘update form’:

See the part where it says “…other organizations“. That is how lawyers word things when they want to open it up to include almost anything. You can drive a freight train through that clause!

Such a broad authorization statement is not reasonable in the context of a long-term disability claim. Especially when it is tacked on at the bottom of an update form, you should always get legal advice for your situation, but I am comfortable saying that people should almost never sign general authorizations in disability claims.

Courts regard personal medical information as some of the most sensitive and private types of information. When I graduated from law school, I also received a diploma in Health Law. We were taught to always use ‘specific’ authorizations for health and medical information. This means the authorization should be specific to the type of health information disclosed. And specific to the person or company. Authorization should never be given generally to everyone, which is what is happing with the above clause.

Solution: Get specific legal advice for your situation. My general recommendation is that you simply cross out this section and write: “no authorization given” in the margin. Then go ahead and sign the form. You can then include a cover letter saying you don’t want to sign a general authorization but will consider signing any specific authorization they need. However, my legal advice to you may be different depending on the facts of your case.

The Jailhouse Confession Trap

This last trap is the worst of the worst. I am sure you have heard that lawyers always tell people to keep their mouths shut when detained by police. If you are detained by police for questioning, there is nothing you can say to help your situation. You can only make things worse. It’s a matter of how much worse you make things.

However, the problem is that most people don’t listen to this advice. The police take courses on how to get people to talk. And some of them are very good at it. This is why most people talk to the police. They will convince you that talking is the best option. And sadly, most people do. Some will even give a false confession. Yes, that is an actual thing that happens.

Once you give a false confession, it is very hard to explain it away. Or to undo it. So what does all this have to do with a long-term disability update form? Well, some of these forms include a clause that has much of the same effect as giving a false confession.

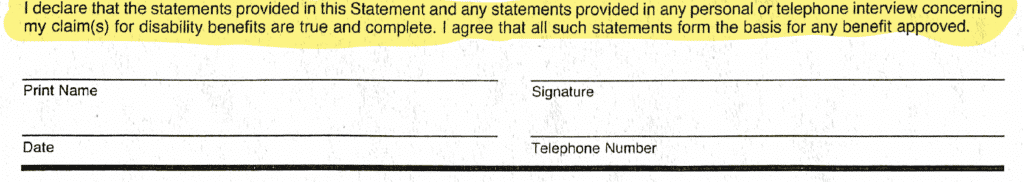

Here is an example of such a clause that appears at the bottom of an update form:

See where it says, “…I declare that the…statements provided in any personal or telephone interview concerning my claim(s)…are true and complete.” This one blows my mind because of how far it overreaches.

Agreeing to this clause has the effect of ‘locking in” any statement you have given to the insurance company. Or any future statements! This includes all the notes from their phone calls with you. Most of which I expect you have never seen.

You are declaring that whatever they wrote down from their conversation with you is “true and complete.” This leaves no room for you to clarify, explain the context, or expand to give more detail. You can’t make changes because you have declared it as “true and complete.” This is what makes it like a false confession.

In my many years as a disability lawyer, I have yet to have a case where we didn’t have to clarify or elaborate on things the client had already told them. Like the police, insurance companies are experts at asking questions in a way to get the information that helps them while getting you to leave out details that help you. When you later want to give the other details. That you didn’t realize where important at the time…SNAP! There goes the trap. They will try to say that because you didn’t tell them this information in the past, you must now be making it up. You signed a form declaring what they had was complete!

Solution: Cross out this section and write “inappropriate clause” in the margin next to it. Like the police, the insurance company may try to convince you that you will “look guilty” if you don’t include it. Hogwash. Don’t fall for that. Call a lawyer for legal advice.

Final Thoughts: Long-term disability update forms

So what should you do? I recommend getting legal advice before signing any form you get from the insurance company. As you can see from the above examples, even a harmless ‘update form’ can have inappropriate clauses that negatively affect your rights. It is ok to fill out the form and cross out sections that are inappropriate. However, get legal advice before doing so. Your situation may be different. You don’t want to cross out questions or clauses that are reasonable.

Free Book Offer