So, you’re applying for CPP disability benefits. You come across some strange wording about sufficient earnings and contributions. You might see this contribution requirement referred to as the minimum qualifying period or MQP. What exactly is the minimum qualifying period?

As part of our Ultimate Guide to CPP Disability Benefits, this article explores one of the more confusing criteria to qualify for CPP disability benefits. I also detail some situations where you might be able to have your MQP calculated differently.

Minimum Qualifying Period

The minimum qualifying period (MQP) is the minimum number of years you must have contributed to the CPP to be eligible to receive disability benefits.

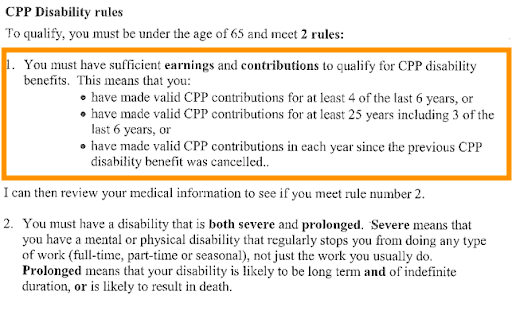

Currently, the rule is this:

You must have made sufficient contributions in four out of the last six years,

or three out of the last six if you have over 25 years of total contributions.

Below is a picture of exactly what the rules are, taken from a letter from Service Canada. The section outlined in orange is what we refer to as the MQP.

Service Canada calculates the minimum qualifying period for disability benefits. They take many different factors into consideration to see when you last had sufficient contributions in 4 years out of a 6-year time period.

This is easily determined in a simple case.

For example:

If you apply in 2020 and have made sufficient contributions leading up to and including 2015, 2016, 2017 and 2018, then stopped contributing, your minimum qualifying period will be December 2020. This means you are eligible to apply for disability benefits up until December 31, 2020. You will want to base your application around this time frame, submitting medical evidence from the years leading up to and including December 2020.

Sufficient Contributions for MQP

Understanding what “sufficient contributions” means can be tricky.

You make contributions to the CPP based on pensionable earnings. There is a minimum and a maximum amount of pensionable earnings. If you make below the minimum amount in a year, then you will not have contributed to CPP that year. This is because you are considered to have made contributions. Once you exceed the minimum pensionable earnings, you are considered to have made contributions.

It’s important to note that the minimum yearly contribution for CPP disability is higher than the contribution for a regular CPP pension. As of 2019, the minimum valid contribution to be eligible for CPP disability benefits is $5700 per year.

Service Canada calculates your disability benefit based on your contributions. This just means that the more you earn, the more you contribute — and the higher your CPP disability pension payments.

To read about this in more detail, please see Service Canada’s page: Canada Pension Plan disability benefit toolkit. While you’re at it, check out our article on CPP Disability Payment Amounts.

Exceptions and Provisions for CPP Disability MQP

There are a few other factors to consider that can change your minimum qualifying period if you don’t have the required amount of contributions.

25 years of contributions

This factor is simple and is stated plainly in the rules. It comes into effect if you have made over 25 years of sufficient contributions. In this case, you only need three years out of 6 to come up with your minimum qualifying period.

For example:

If you have contributed to CPP for 25+ years with sufficient contributions, including 2015, 2016, 2017 and 2018, your minimum qualifying period will be December 2021. Service Canada would take the last three years — 2016 through 2018 — and extend your MQP to 3 years beyond that. You would have until December 31, 2021, to apply.

Child rearing provision

If you don’t have sufficient contributions as a result of being out of the workforce due to being the child’s primary caregiver, then your minimum qualifying period could be raised using the child-rearing provision. The child-rearing provision does not give you contributions for missing years; rather, it closes the gap where you have little or no contributions as a result of being the main childcare provider. When calculating the amount of your benefit, these years don’t count. You are able to claim this provision for up to seven years.

For example:

If you were contributing from 1999 through to 2003 and went off work to take care of your child from 2003-2010, your minimum qualifying period could now be December 2012 or 2013, as opposed to December 2005 without the provision. The years 2003-2010 are essentially erased.

Late Application Provision

If you haven’t been making contributions to the CPP because you haven’t been able to work as a result of your disability, your claim can be assessed under the late application provision. This basically means that the adjudicator will refer back to the last time you had contributions in 4 out of 6 years. If you can prove that you were eligible for the CPP disability benefit when you were not working and would have been approved if you had applied then and continued to be approved until the present, you can qualify for the benefit after your MQP.

For example:

If you stopped contributing in 2005, in most cases, your minimum qualifying period would be December 2007. Under the late application provision, you would no longer qualify for CPP disability benefits if you were applying in 2020 because your minimum qualifying period was 13 years ago!

You can get your benefit approved if you can prove the following:

- you were qualified in 2007 for the CPP disability benefit

- that you would have been approved if you had applied then

- that you would continue to be qualified until 2020 and for the indefinite future.

In these cases, it is extremely important to have medical information from the time frame of your MQP — leading up to the year 2007, in this example.

International contributions

If you were living and/or working outside of Canada, you might not have been contributing to the CPP — but perhaps you were contributing to another program. Depending on the country you were residing in, you may be able to transfer your credits into qualifying contributions in Canada for those years.

Canada has international social security agreements with over 50 countries, including America, Australia, France, Germany, Japan, and many more. Contact your local Service Canada office to see if the country that you worked in qualifies for this provision.

Credit Splitting

Credit splitting is for those who were married or common-law but are now legally separated or divorced. You could be eligible for credit splitting to make up insufficient contributions. Service Canada will take the pensionable credits from both parties, add them up for the years that there was cohabitation, and then divide them equally between both parties. Credit splitting can help bump up your minimum qualifying period to make you eligible for the CPP disability benefit.

Incapacity Provision

Finally, Service Canada also has the incapacity provision in place. This is in case your disability prevented you from applying during your qualifying period. To qualify for this provision, you must be physically and mentally incapacitated and completely unable to apply yourself. You must also be unable to request that someone else applies on your behalf. There is a time restriction on this provision; you must then apply within a year of regaining your capacity.

Next Step – Get Our Free Book

Start making better decisions today. Click on the link below to request an instant download of our free book.